HALAL CRYPTO

Halal or Haram?

Crypto has sparked discussions within the Muslim community about its compatibility with Islamic principles. However, an increasing number of scholars and Muslims recognize the potential of Crypto within the boundaries of halal practices. Let’s look at halal Crypto and how to differentiate between halal and haram Crypto. Staking has also been a thorn that we will talk about. Before we dig deeper, it’s good to know what Shariah scholars think about Crypto.

Shariah Scholars’ Perspective

In recent years, Crypto has gained widespread attention and adoption. While some may question its legitimacy, many scholars have supported Crypto as halal or permissible under Islamic law. In fact, Crypto’s alignment with Islamic principles has been a topic of discussion among scholars for several years.

The use of Crypto aligns with Islamic principles of financial justice, transparency, and accountability. Like Islamic finance, Crypto follows the principles of risk sharing and mutual benefit. It also removes the need for middlemen, which can sometimes lead to exploitation and unfairness in traditional financial systems.

Halal Nature of Crypto

One of the main reasons for this support is Crypto’s nature. Unlike traditional currency backed by a central authority, Crypto is decentralized, meaning it is not controlled by a single entity. This decentralization ensures that no one entity controls the currency, and transactions can be conducted with transparency and security.

Crypto’s halal status comes from many arguments put forward by Muslim proponents. The most commonly cited idea is that Crypto, like gold, doesn’t need backing from a physical asset or an authority. Gold has been accepted as a valuable asset throughout history despite lacking intrinsic value. Similarly, Crypto gets its value from scarcity, utility, and demand.

The second point to consider is the volatility of Crypto. Critics argue that the excessive rise and drop in the value of Crypto makes it unsuitable for Muslim investors. However, volatility is not unique to the crypto market. Forex and stock markets also have significant price differences, yet they remain acceptable for Muslims. The important thing is informed decision-making and proper risk management methods when dealing with Crypto.

It is essential to note that in Islamic finance, things are generally considered halal unless proven otherwise. Since Crypto has no inherently haram traits, it is presumed to be halal by default. However, a background check for any crypto is crucial to ensure it aligns with Shariah principles.

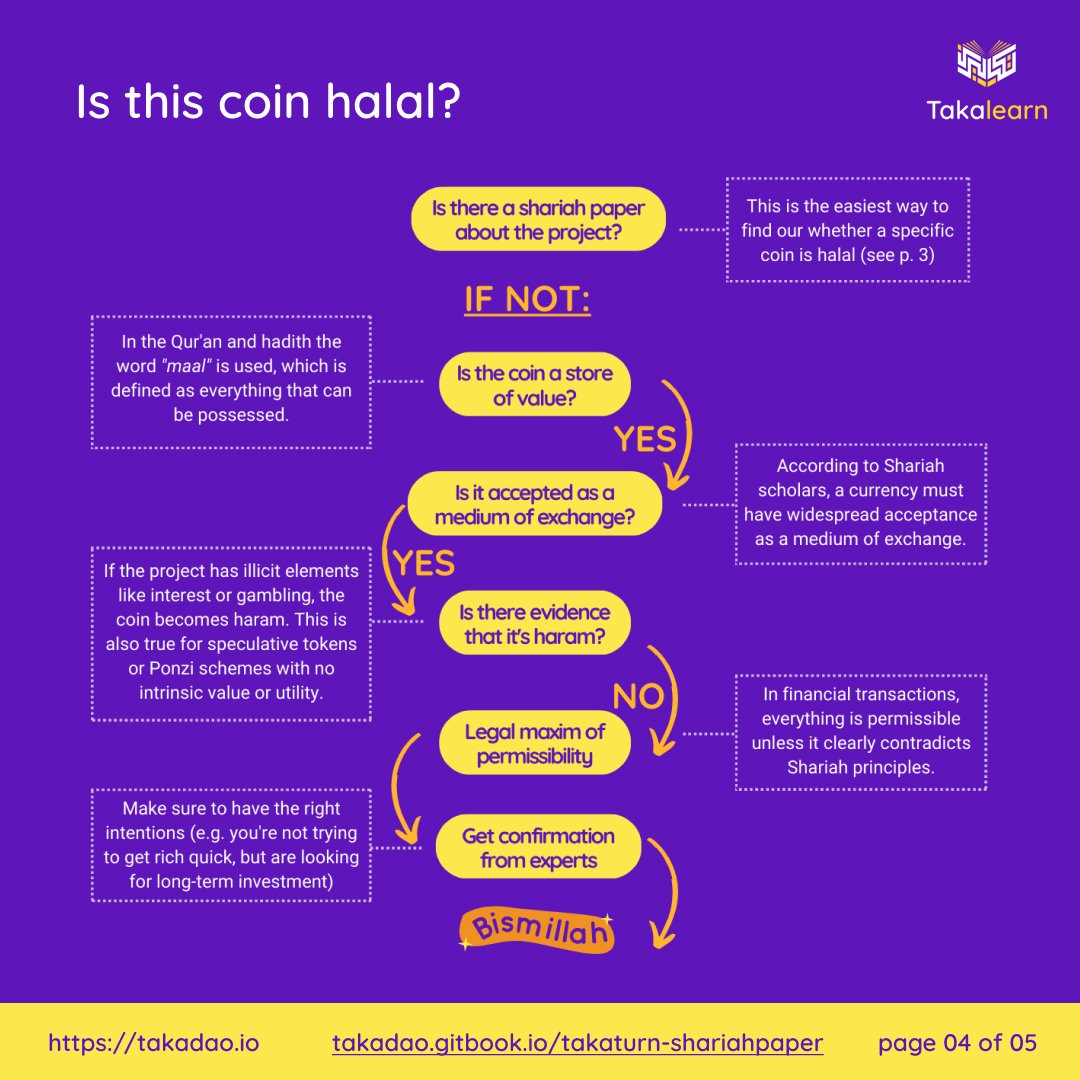

As you do a background check of your preferred Crypto or Crypto project, let’s look at how you can identify the halal ones.

Identifying Halal Crypto

Suppose you want to know whether a specific crypto is halal. You need to do a background check and understand its operation’s rules. Always DYOR (Do Your Own Research). Reading a crypto’s whitepaper, which explains its purpose, the technology used, and how it operates, lets you know if it aligns with Islamic principles. Always look for a Crypto that values transparency, avoids riba-based lending, and follows ethical business practices.

There are specific considerations that need to be taken into account when identifying halal Crypto. First, Crypto must not be based on debt, as interest-based transactions are prohibited in Islam. Second, the asset must have intrinsic value, meaning it must have a use or purpose beyond simply being a tradable asset. Third, Crypto must not be associated with haram activity like gambling or pornography.

Many Crypto projects market themselves as Shariah-compliant, undergo thorough audits, and get certifications from respected Islamic finance institutions. These certifications reassure Muslim investors regarding the compliance of Crypto with Shariah principles.

Lastly, as you wade through the world of Crypto, seek advice from knowledgeable scholars or experts in Islamic finance. Their advice can provide relevant and specific guidance and help you make informed decisions.

In Crypto, there is also the issue of staking that we mentioned earlier. This article would be incomplete if we didn’t discuss the types of staking and whether they’re halal.

Staking-Validating Transactions vs Earning Interest

When it comes to staking there are different types of staking, and it is essential to understand which are halal and which are not. Staking involves holding Crypto in a wallet to support the network and earn rewards. Proof of Stake (PoS) staking is generally considered halal, similar to profit-sharing, which Islam allows. However, some scholars have raised concerns about Masternode staking, which involves running a full node and requires a large investment, as it may be seen as a form of gambling.

In general, staking to validate transactions is considered halal because it contributes to the security and efficiency of the blockchain network. This type of staking aligns with the principle of cooperation and support within a community.

However, staking that involves lending Crypto for riba(interest) or earning interest on staked assets is considered haram (prohibited) in Islamic finance. Islam is against engaging in interest-based transactions because they exploit borrowers and promote inequality.

Conclusion

This article has separated the wheat from the chaff. Don’t fear Crypto. Do your own research and find Crypto or Crypto projects that align with Islamic principles. Look out for our next piece discussing more financial literacy.